The biorational pesticides market is gaining strong momentum as growers, agribusinesses, and regulators emphasize sustainable crop protection solutions that reduce environmental impact while maintaining yield.

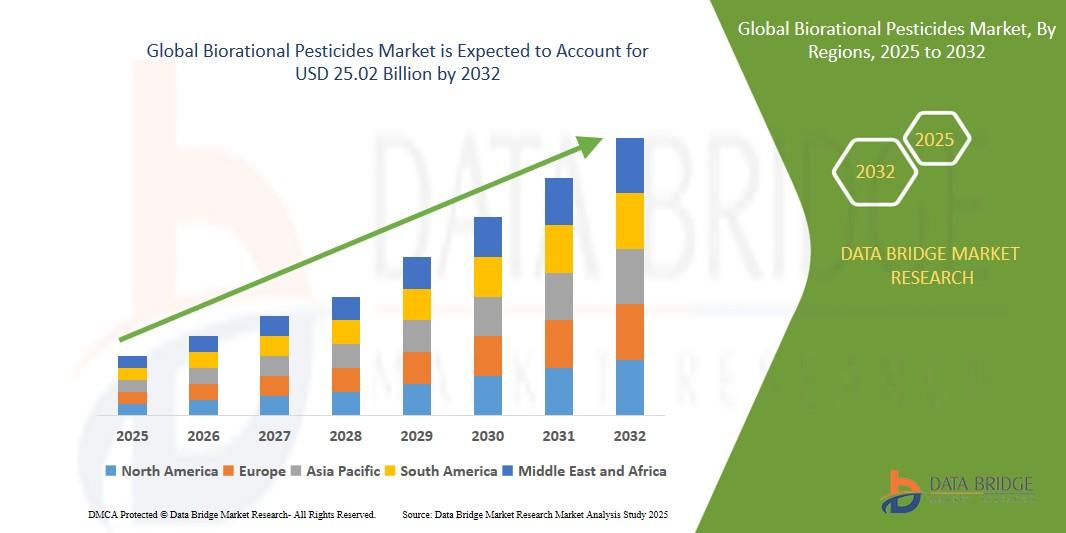

The global biorational pesticides market was valued at USD 6.9 billion in 2024 and is expected to reach USD 14.6 billion by 2032, growing at a CAGR of 15.4%

Biorational pesticides — including biopesticides, botanical extracts, microbial agents, and bioherbicides — offer targeted pest control with lower toxicity, improved biodegradability, and compatibility with integrated pest management (IPM) programs. This shift is driving growth in market size and expanding share across major agricultural regions.

Market Overview

Biorational products are increasingly adopted across row crops, fruits and vegetables, ornamentals, and specialty crops. Their appeal lies in selective modes of action, low residue profiles, and suitability for organic and residue-sensitive markets. Demand is being fueled by stricter regulations on synthetic chemistries, consumer preference for residue-free produce, and the need for resistance-management strategies that extend the useful life of conventional pesticides.

Key Growth Drivers

-

Regulatory Pressure and Phase-Outs: Bans and restrictions on certain synthetic pesticides are encouraging farmers to adopt biorational alternatives that comply with evolving safety and environmental standards.

-

Sustainability & Consumer Demand: Retailers and food brands increasingly require reduced-chemical inputs and traceability, prompting growers to use biorationals for market access.

-

Integrated Pest Management (IPM) Adoption: Biorational pesticides fit well into IPM programs, providing complementary modes of control along with cultural and biological measures.

-

Advances in Formulation & Delivery: Improved formulations, microencapsulation, and adjuvants are enhancing efficacy, persistence, and ease-of-application for biorational products.

-

Growth in Specialty & Organic Farming: Expanding acreage under organic and specialty production supports higher per-hectare use of biopesticides and botanicals.

Segmentation Insights

By Product Type

-

Microbial Pesticides (bacteria, fungi, viruses) — widely used for insect and disease control.

-

Botanical Extracts (neem, pyrethrum, azadirachtin) — popular for broad-spectrum and foliar applications.

-

Biochemical Pesticides (pheromones, insect growth regulators) — used for mating disruption and specific pest lifecycle control.

-

Plant Extracts & Oils — niche but growing segments for organic markets.

Microbial and biochemical segments are recording rapid uptake due to high specificity and regulatory acceptance.

By Target Pest

-

Insecticides

-

Fungicides

-

Herbicides

-

Nematicides

Biological insect control and biofungicides are leading in adoption because of efficacy and compatibility with beneficial insects.

By Crop Type

-

Cereals & grains

-

Fruits & vegetables

-

Oilseeds & pulses

-

Ornamentals & turf

-

Others

High-value horticulture and specialty crops often show the highest per-unit consumption due to stricter residue limits.

By Formulation

-

Liquid concentrates

-

Wettable powders

-

Granules

-

Emulsifiable concentrates

Liquid and sprayable formats dominate field application, while seed treatments and soil-applied biocontrols are gaining interest.

Regional Outlook

-

North America & Europe: Strong regulatory frameworks and demand for residue-safe produce drive biopesticide adoption. Research funding and start-up ecosystems accelerate product development.

-

Asia-Pacific: Rapid growth driven by increasing awareness, supportive government programs, and large-scale horticulture; cost and supply-chain localization are key to wider adoption.

-

Latin America: Large agricultural footprint and resistance concerns are pushing farmers to integrate biorationals into IPM, though scale-up depends on affordability and extension services.

-

Africa & Middle East: Emerging usage, particularly in high-value export crops, with growth tied to farmer education and distribution networks.

Challenges and Restraints

-

Variable Field Performance: Efficacy can be more condition-dependent vs. synthetic pesticides, requiring precise timing and integrated application strategies.

-

Registration & Standardization: Complex and costly regulatory pathways in certain markets slow commercialization. Harmonized data packages and clear guidelines would accelerate approvals.

-

Shelf-Life and Storage: Some biologicals require cold-chain or stabilized formulations to maintain viability, increasing logistics complexity.

-

Price Sensitivity: In high-volume row crops, cost parity with conventional chemistry is critical for large-scale adoption.

Competitive Landscape & Innovation

The space features a mix of multinational agrochemical firms, specialized biopesticide companies, and agri-tech startups. Strategic moves include partnerships with formulation experts, acquisitions of niche biocontrols, and licensing agreements with research institutions. Innovations focus on strain improvement, microbial consortia, RNAi-based biopesticides, and smart delivery systems that improve persistence and target specificity.

Market Forecast & Opportunities

Over the next 5–10 years, the biorational pesticides market is expected to expand rapidly as growers balance productivity with sustainability. High-growth opportunities include:

-

Commercialization of RNAi and next-gen microbial agents that offer crop-specific control with minimal off-target effects.

-

Seed treatments and soil health products combining biostimulants with biopesticides for preventive protection.

-

Digital agronomy services that optimize application timing and integrate pest scouting with biopesticide use.

-

Contract manufacturing and local formulation hubs in emerging regions to reduce costs and improve supply resilience.

Adoption will accelerate where extension services, demonstration plots, and retailer procurement policies favor low-residue production.

Browse More Reports:

Global Hybrid Imaging Market

Global Indirect Debris Removal Market

Global Integrated Labelling System Market

Global Low Emission Vehicles Market

Global Metal Carboxylate Market

Global Microcontroller for Parking Assist System Market

Global Micro-Perforated Food Packaging Market

Global Mortuary Equipment Market

Global Non-volatile Memory Express Market

Global Obesity Treatment Market

Global Ophthalmic Packaging Market

Global Organic Asphalt Modifiers Market

Global Printed Tape Market

Global Propionic Acid for Animal Feed Market

Global Rear Electric Axle (E-Axle) Market

Conclusion

The biorational pesticides market presents compelling growth opportunities as agriculture transitions toward resilient, sustainable production systems. While challenges around performance consistency and regulatory complexity remain, technological advancements and greater market pull for eco-friendly crop protection are set to drive broad adoption. Stakeholders that invest in R&D, farmer education, and scalable distribution will be best placed to capture the expanding market share in the coming years.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com