The Middle East and Africa treasury software market is witnessing significant expansion as organizations across banking, corporate enterprise, and government sectors move toward digital treasury operations.

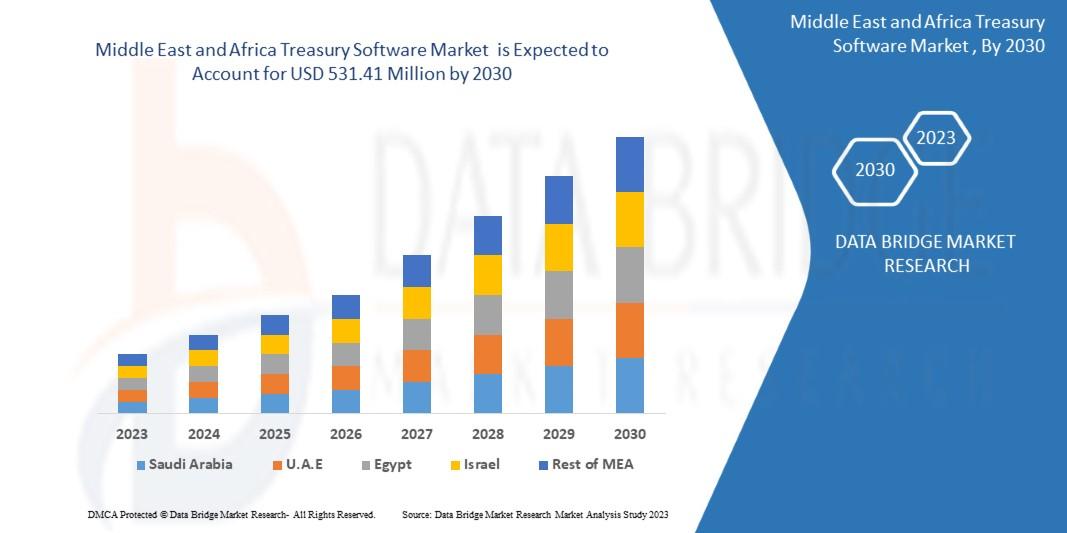

Data Bridge Market Research analyses that the market is growing with the CAGR of 2.5% in the forecast period of 2023 to 2030 and expected to reach USD 531.41 million by 2030.

The rising need for liquidity management, real-time financial visibility, and automated cash flow processes is driving the adoption of advanced treasury technologies across the region. With growing digital transformation initiatives, improved compliance requirements, and increased cross-border financial activity, treasury software has become an essential tool for modern financial management in MEA.

Market Overview

Treasury software enables companies to manage cash, liquidity, financial assets, and risk with improved accuracy and transparency. In the Middle East and Africa, the market is accelerating due to:

-

Strong demand for digital treasury centralization

-

Rapid fintech ecosystem development

-

Growth in enterprise automation

-

Rising need for real-time analytics and forecasting

-

Increasing complexity of multi-currency operations

Sectors such as BFSI, large enterprises, telecom, energy & utilities, and government finance departments are integrating treasury solutions to strengthen financial governance and streamline decision-making.

Market Size and Growth Outlook

The market is positioned for steady growth as digital banking expands and enterprises prioritize financial automation. Organizations are seeking solutions that enhance:

-

Cash positioning accuracy

-

Liquidity forecasting

-

Payment automation

-

Risk assessment and compliance

-

Bank account management

Growing financial regulations, economic diversification initiatives across GCC countries, and digitization programs across Africa are expected to support the market’s long-term growth trajectory.

Key Market Drivers

1. Rising Adoption of Real-Time Treasury Operations

Businesses are moving from manual spreadsheets to automated platforms that offer real-time insights into cash flow, financial exposure, and liquidity positions. Instant visibility is becoming crucial for managing currency fluctuations and market volatility.

2. Expansion of Digital Banking and Fintech Integration

The region’s thriving fintech sector supports treasury modernization by offering seamless connectivity with banks, ERP platforms, payment gateways, and financial analytics tools.

3. Growing Emphasis on Risk and Compliance Management

Treasury software supports regulatory compliance by automating reporting, managing audit trails, and reducing human error. This is particularly important for financial institutions operating across multiple jurisdictions.

4. Shift Toward Cloud-Based Treasury Systems

Cloud treasury solutions are gaining popularity due to lower implementation costs, easy scalability, and continuous updates—ideal for mid-sized enterprises and fast-growing corporates.

Market Challenges

Despite rapid adoption, some challenges persist, including diverse regulatory frameworks across MEA, limited digital infrastructure in rural African economies, and cybersecurity concerns. However, ongoing government investment in digital transformation is helping address these gaps.

Segmentation Analysis

By Deployment Mode

-

Cloud-Based

-

On-Premise

Cloud-based solutions are growing fastest due to flexible operations and reduced upfront investments.

By Enterprise Size

-

Large Enterprises

-

Small and Medium-Sized Enterprises (SMEs)

SMEs are increasingly investing in treasury platforms to improve cash visibility and streamline banking operations.

By Application

-

Cash and Liquidity Management

-

Risk and Compliance Management

-

Payment Management

-

Financial Reporting and Analysis

-

Bank Account Management

Cash and liquidity management remains the dominant segment due to rising demand for accurate forecasting.

By End User

-

Banks and Financial Institutions

-

Corporate Enterprises

-

Government and Public Sector

-

Energy, Telecom, and Manufacturing

Banks and corporate enterprises represent the largest share of adoption.

Competitive Landscape

Key players in the Middle East and Africa treasury software market include:

-

Kyriba

-

SAP

-

FIS Global

-

Finastra

-

Oracle

-

Gtreasury

-

TreasuryXpress

-

ION Group

These companies are expanding their footprint through cloud platforms, API integrations, AI-driven forecasting, and advanced analytics capabilities.

Future Outlook (2024–2031)

The market is expected to grow steadily as MEA enterprises prioritize financial automation, improve liquidity controls, and enhance risk management through digital platforms. Emerging trends that will shape the market include:

-

Increased use of AI for predictive treasury analytics

-

Higher demand for integrated payment hubs

-

Expansion of treasury-bank connectivity via open banking

-

Growth in mobile treasury management solutions for remote access

With increasing adoption across sectors, treasury software will play a critical role in strengthening financial resilience and supporting the region’s economic transformation.

Browse More Reports:

Global Horticulture Lighting Market

Global Polyvinyl Chloride (PVC) Compound Market

Global Dental Chairs Market

Global Makeup Remover Market

Global Taurine Market

Global Database Security Market

Global Corrugated Packaging Market

Global Small Wind Market

Global Caffeine Supplements Market

Global Locomotive Market

Global Molecular Breeding Market

Middle East and Africa White Goods Market

North America White Goods Market

Europe Unmanned Surface Vehicle (USV) Market

Middle East and Africa Treasury Software Market

Conclusion

The Middle East and Africa treasury software market continues to expand as organizations embrace digital treasury transformation to manage financial operations with greater efficiency and reliability. With advancements in cloud computing, AI, regulatory compliance tools, and treasury automation, businesses in MEA are well-positioned to optimize liquidity, strengthen risk mitigation strategies, and drive long-term financial growth.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com